Beyond Austin: Lockhart’s Rise as a Multifamily Investment Hub

As 2025 progresses, Texas remains a powerhouse for real estate investment—driven by robust population growth, a business-friendly environment, and compelling tax advantages. But beyond the major metros, emerging submarkets like Lockhart are capturing attention for their untapped potential and strategic positioning within the state’s expanding economic corridors.

For high-net-worth individuals and limited partners seeking durable returns, understanding the local forces shaping real estate in places like Lockhart isn’t just smart—it’s imperative.

Key Takeaways for LPs Considering Lockhart Multifamily Investments

- Strong Demographic Tailwinds: Steady population growth, inbound migration from major metros, and a balanced age distribution create a resilient renter pool—ideal for both conventional multifamily and niche segments like senior housing or contractor-friendly rentals.

- Employment Stability with Sector Diversity: Lockhart’s proximity to Austin and San Antonio fuels job growth across retail, construction, education, logistics, and tech—supporting tenant stability and reducing exposure to single-industry risk.

- Affordability Supports Demand: Favorable rent-to-income ratios, rising home prices, and low vacancy rates point to sustained rental demand and high occupancy potential—especially for workforce housing aligned with local income levels. Migration trends and employment shifts to affordability metrics and regional spillover effects.

Whether you’re investing through syndications, private equity funds, or direct acquisitions, these insights will help you align capital with opportunity.

Lockhart, TX, Real Estate Investment Data

Let’s dive into the Lockhart, TX real estate market from the perspective of limited partners (LPs) considering investments in multifamily deals. It’s not one of our top five Texas cities, but it has strong potential. As LPs, your focus is on assessing risk, return potential, and market stability before committing capital to a general partner (GP) managing these investments.

Let’s bring to the surface pertinent data across the key categories —local economic and demographic drivers, population growth, employment and income, and housing affordability and demand—drawing from available insights and analyzing their implications for multifamily investment.

Disclosure: Driftwood Equity Partners maintains direct investments in Lockhart-based multifamily properties.

Local Economic & Demographic Drivers

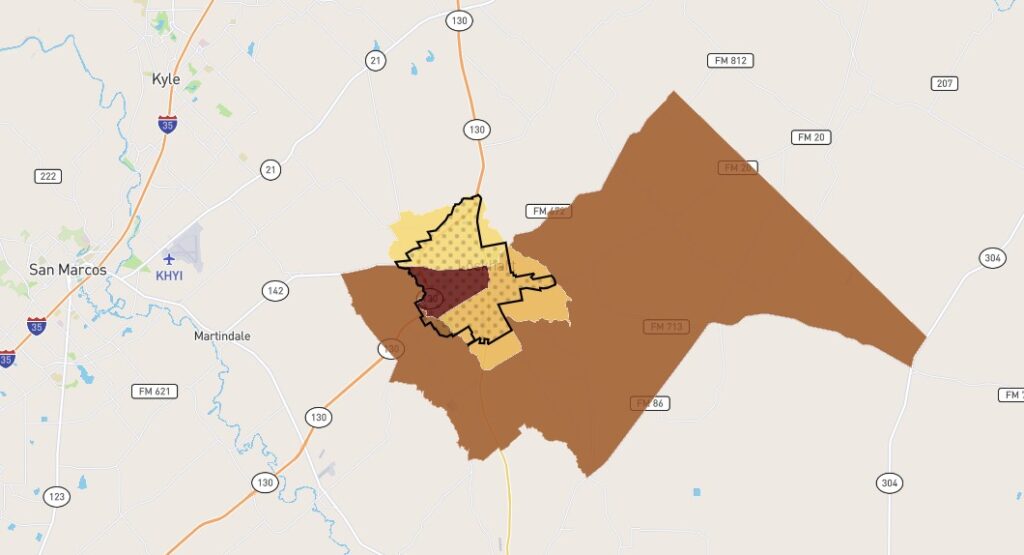

Overview for LPs: Lockhart’s economic and demographic landscape provides a foundation for evaluating multifamily investment viability. Its proximity to Austin and San Antonio, part of the Austin-Round Rock Metropolitan Statistical Area, positions it as a growth hub with spillover benefits, though it retains a smaller, community-driven character.

- Population Growth: Lockhart’s population has grown steadily, reaching 14,844 in 2021 and estimated at 15,318 by 2022, with a 29% increase since 2000. This growth trend, projecting a potential doubling by 2040, signals rising housing demand, a key metric for multifamily LPs.

- Migration Patterns: Significant inbound migration from Austin and San Antonio, driven by affordability and lifestyle appeals, boosts rental demand. Redfin data shows 26% of homebuyers searched to move out of Lockhart, while 74% stayed within the metro area, with inflows from Los Angeles, Dallas, and San Francisco2. This suggests a net inflow of renters, favorable for multifamily occupancy.

- Age Distribution: The median resident age is 38.1 years, slightly above Texas’s 35.9 years, with a mix of younger renters (25-34) and an aging population. This duality supports multifamily demand—young professionals seeking apartments and retirees favoring low-maintenance rentals.

LP Insight: The youthful demographic and migration trends indicate a robust renter pool, reducing vacancy risks, while the aging population may drive demand for senior housing within multifamily portfolios. Plus, demand is rising in rentals along with long-term RV Parks for contractors for the local construction.

Employment & Income

Overview for LPs: Employment stability and income levels are critical for assessing rental payment capacity and long-term market health.

- Major Employers: Lockhart benefits from its location between Austin and San Antonio, with employment growth in Caldwell County at 24.8% over the past decade. Key sectors include retail trade (15.4%), construction (12.7%), and educational services (10.6%), with tech spillover from Austin adding diversification.4

- Median Household Income and Job Growth: The median household income in 2023 was $66,801, slightly below Texas’s $75,780, with per capita income at $29,198. Job growth supports this, with a 3.9% unemployment rate in November 2024, better than the state’s 4.2%.

- Industry Diversification: Beyond traditional sectors, logistics and manufacturing are growing due to Lockhart’s central location and transportation links (e.g., Union Pacific Railway). Tech spillover from Austin enhances this mix, reducing reliance on any single industry.

LP Insight: Diverse employment and steady job growth suggest a stable tenant base, though the lower median income compared to state averages may limit rent escalation potential. LPs should favor GPs targeting workforce housing to align with income levels.

Housing Affordability & Demand

Overview for LPs: Affordability and demand metrics help gauge investment returns and rental market saturation.

- Rent-to-Income Ratios: With a median gross rent of $1,225 in 2023 and median household income of $66,801 ($5,566 monthly), the rent-to-income ratio is approximately 22%, below the recommended 30% threshold. This indicates affordability, supporting multifamily rental demand.5

- Single-Family Home Prices vs. Multifamily Rents: The median home value in 2023 was $249,013, with a mean price of $234,187, while recent sales show rents supporting multifamily viability (e.g., $300K median sale price vs. $1,225 rent). Rising home prices (up 5.3% year-over-year) push more residents toward renting.

- Vacancy Rates Across Asset Classes: Specific multifamily vacancy data is limited, but the housing market remains tight, with few homes for sale and apartment waiting lists. Single-family vacancy is low (3% rural), suggesting strong overall demand across asset classes.

LP Insight: The favorable rent-to-income ratio and low vacancy rates signal a seller’s market with high occupancy potential for multifamily units. However, rising home prices may increase land costs, impacting development feasibility—LPs should scrutinize GP cost management strategies.

Key Takeaways for Limited Partners

For LPs eyeing Lockhart multifamily deals, the data paints a promising yet nuanced picture:

- Upside Potential: Population growth (29% since 2000), migration from major metros, and a tight housing market suggest strong rental demand, supporting cash flow stability.

- Risk Considerations: Lower median income and potential land cost increases require GPs to target affordable housing segments and optimize construction budgets.

- Investment Strategy: Focus on workforce housing or mixed-income multifamily projects near employment hubs, leveraging Lockhart’s diversification and proximity to Austin’s tech corridor.

LPs should request detailed pro formas from GPs, emphasizing rent growth projections, vacancy buffers, and exit strategies, given the market’s growth trajectory6. With 185 single-family permits in 2022 and multifamily potential untapped, Lockhart offers a strategic entry point for savvy multifamily investors in 2025.

Sources

- Neighborhood Scout – https://www.neighborhoodscout.com/tx/lockhart

Lockhart is a medium-sized city located in the state of Texas. With a population of 15,318 people and four associated neighborhoods, Lockhart is the 199th largest community in Texas. ↩︎ - Redfin. Lockhart, TX Housing Market – https://www.redfin.com/city/11001/TX/Lockhart/housing-market

In July 2025, Lockhart home prices were down 8.6% compared to last year, selling for a median price of $273K. On average, homes in Lockhart sell after 85 days on the market compared to 34 days last year. There were 20 homes sold in July this year, down from 32 last year. ↩︎ - Neighborhood Scout – https://www.neighborhoodscout.com/tx/lockhart/real-estate

Average Market Rent: $1,434 / per month, 8.9% Vacancy Rate. ↩︎ - City of Lockhart Economic Development – https://lockhartedc.com/local-data/demographics

Over the past ten years, employment in Caldwell County has grown by 24.8%

Approximately half of Lockhart working adults earn an income of between $50,000 and $150,000 annually.

↩︎ - Private Equity Lion. Critical Marketin Implications in the Sunbelt – https://privateequitylion.com/2025/06/05/critical-market-implications-for-sun-belt-real-estate/ ↩︎

- Garner Economics LLC, PDF Report “Competitive Reality Report and Target Industry Strategy for Lockhart, TX” – https://lockhartedc.com/assets/downloads/Final-Garner-Report-for-printing-1603822083.pdf ↩︎

Credit: Marketing for Financial Sector

More Resources

- Multifamily Syndication: A Step-by-Step Guide to Maximum Returns

- Getting Started in Multifamily Syndication for Passive Income

- Why Multifamily Real Estate Can Be a Powerful Hedge Against Inflation

- Taming Inflation, The Basics that Investors Need to Know

- Top 5 Texas Cities for Multifamily Investing in 2024

- Texas Real Estate Trends Mid-2024